CREDIT TERMS

Credit terms define the payment conditions agreed upon between a buyer and a seller for services purchased on credit. These terms include the payment due date.

Key Elements:

Due Date: Specifies when the payment is due (e.g., within 30 days, 60 days, etc.).

Credit Limit: The maximum amount of credit that can be extended to the partner.

To Create Credit Terms:

Login as a Partner → Main menu → Customer → Credit Terms.

Add Credit Terms:

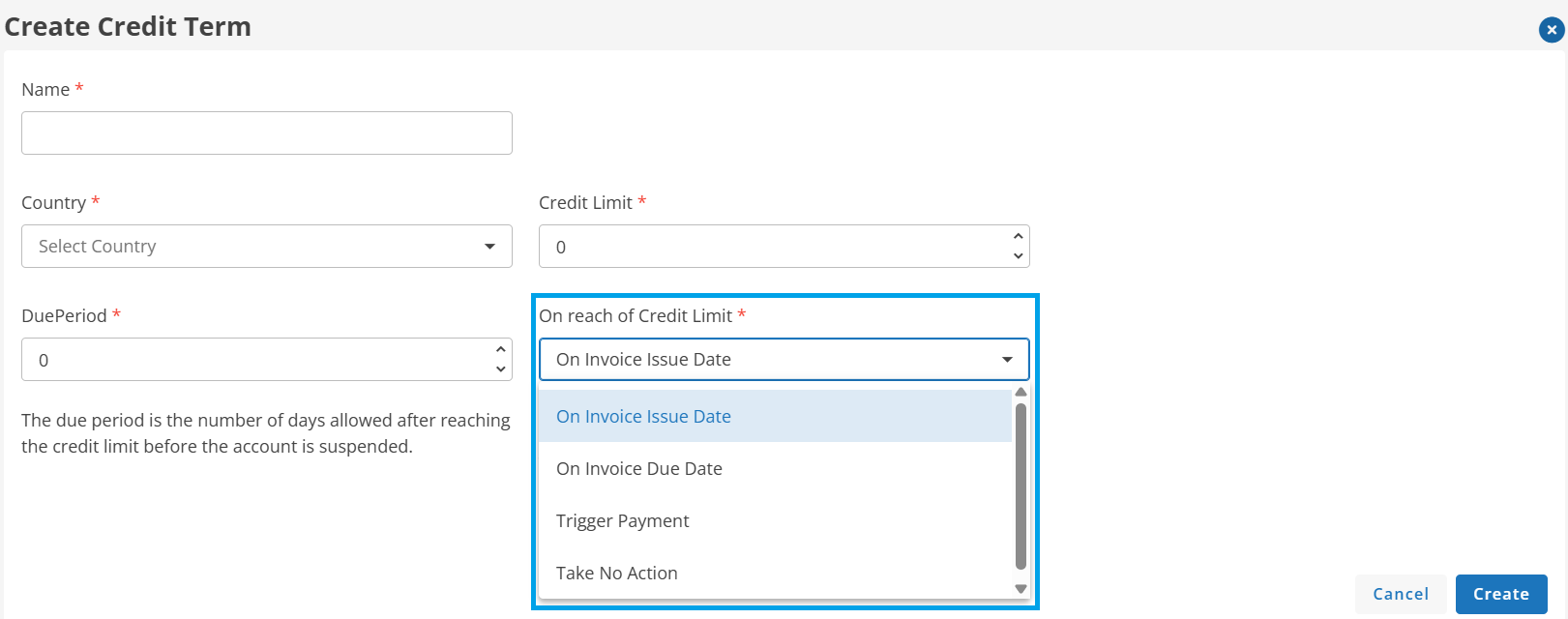

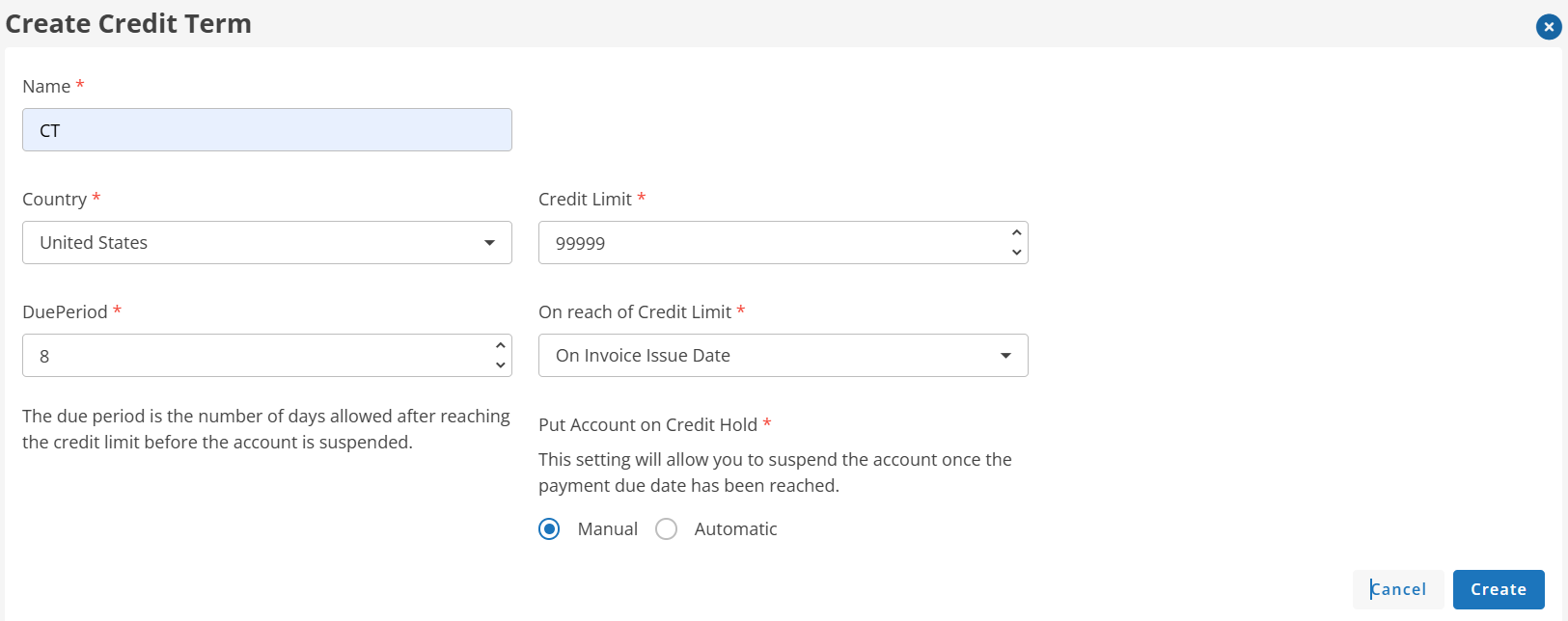

Click on the "Create" button to initiate credit term creation.

Enter Credit Term Details:

- Name for this Credit Term: Provide a clear and descriptive name.

- Country: Select the country where the credit term will apply.

- Credit Limit: Set the credit limit.

- Due Period: The due period is the number of days allowed after reaching the credit limit before the bank account is suspended.

On Reach of Credit Limit:

- On Invoice Issue Date: Suspend the account when the invoice is issued.

- On Invoice Due Date: Suspend the account on the invoice due date.

- Trigger Payment: Automatically trigger a payment process when the credit limit is reached.

- Take No Action: No action is taken when the credit limit is reached.

Put Account on Credit Hold:

This setting will allow you to suspend the account once the payment due date has been reached.

Either choose Manual or Automatic.

Manual: Selecting this option allows the admin to manually suspend the distributor's account when necessary.

Automatic: Selecting this option will automatically suspend the distributor's account when the credit limit is reached.

Click the "Create" button to finalize and save the new Credit Term.

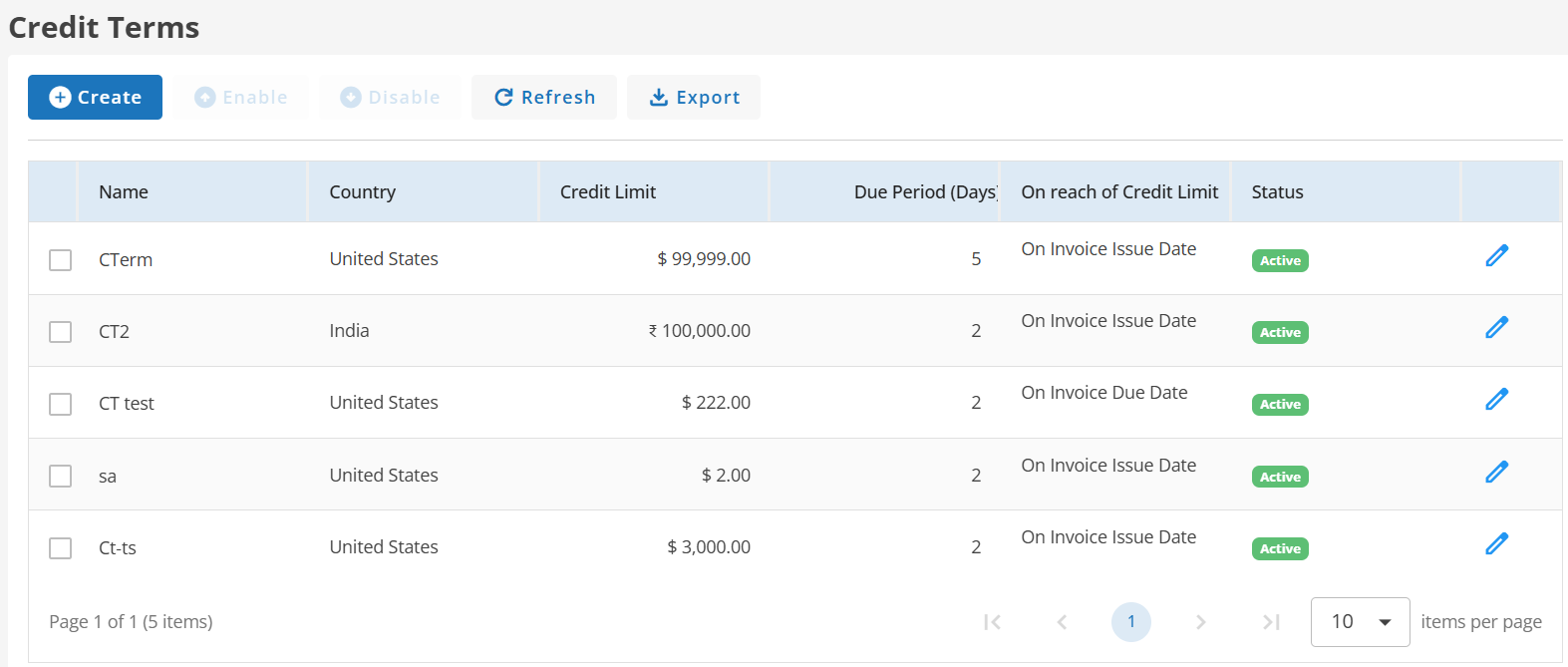

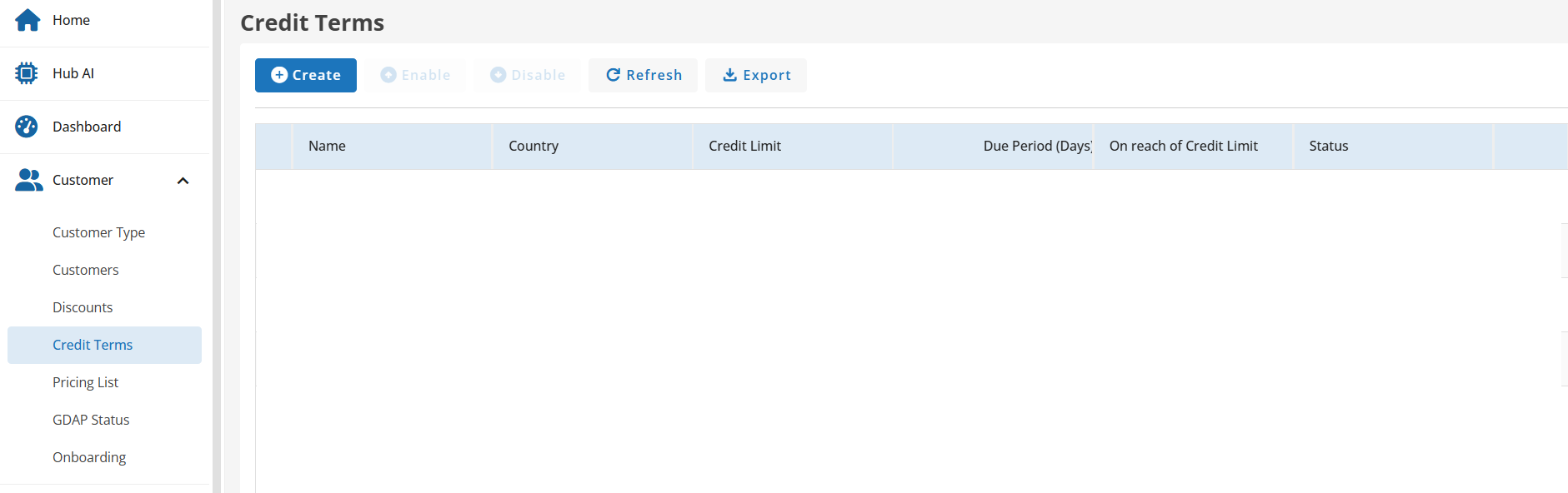

Credit Terms Grid Page: